Ready for a DMZ hot take? Being able to articulate a startup win is just as important as the win itself. Reaching a significant milestone will be exponentially more impactful to your business if you share the success publicly. This is where press releases come in — a strategic symphony of words that transforms startup wins into news.

For those new to the public relations world, a press release is an announcement made on behalf of your company about an achievement or new development. It serves as a tool to communicate the announcement to a wide range of stakeholders: customers, investors, partners and the media. Understanding how to craft a strong press release can be a cost-effective form of marketing, as it can lead to earned media, enhanced brand recognition and improved SEO. However, the media will not jump on every press release you write, and that’s expected! It’s important to note that not every startup update needs a press release.

Here are some examples of when you should write a press release:

- Partnership announcements

- Funding announcements

- Product launches

- Company award or accolade

- Mergers and acquisitions

- Company rebrand

Now that we’ve established the need behind a press release let’s dive into how you can craft your own.

Define your public relations goals.

Before you start writing any announcement, define what your broader public relations goals are. While the ultimate goal is to bring attention to your company, you need to specify what you hope to achieve long term. For more support on mapping out your strategy and where you can start as a founder, head to DMZ’s top 4 insider tricks for public relations success.

Keep it formal and to the point.

Press releases embody professionalism, so use formal language and factual details. Remember to use plain language and avoid unnecessary fluff. Unlike a blog or social media, press releases are not based on personal opinions and don’t fully leverage your brand voice. Explore the differences in tone and formality for the same DMZ announcement across mediums.

- A press release announcing DMZ’s Women of the Year

- A blog sharing DMZ’s Women of the Year

- An Instagram post sharing DMZ’s Women of the Year

Utilize the 5W’s.

Use the 5W’s as a guide to ensure a well-structured opening paragraph. This includes the who, what, where, when, and why to provide relevant information and avoid straying off-topic. Readers should be able to identify what your press release is about in the first few sentences. Check out the opening paragraph of a recent DMZ press release.

- “On Monday, June 26, Toronto Metropolitan University’s DMZ hosted the highly anticipated Insiders Event at the incubator’s headquarters in downtown Toronto. The exclusive showcase featured a handpicked selection of innovative startups from DMZ’s portfolio, giving attendees the opportunity to hear how they are transforming their respective industries.”

Include quotations.

Including quotations dramatically enhances the impact of an announcement. They can add a human element by sharing an individual’s perspective. A strong quote should highlight why your news is relevant now; think of it as a soundbite media could lead with. Aim to include at least one quote from your team and one from an external organization. See below for an example of a quote included in this DMZ press release.

- “Given Japan’s longstanding reputation as a pioneer in global innovation, it is an honour that JETRO has selected DMZ as its Canadian partner for the Global Acceleration Hub,” said Abdullah Snobar, Executive Director, DMZ, and CEO, DMZ Ventures. “This collaboration is a testament to both countries’ vision to foster business growth beyond borders, and we’re eager to unlock business expansion opportunities for Japanese startups visiting Toronto this month.

Include a boilerplate.

A boilerplate is a short, standardized paragraph at the end of a press release that provides high-level background on your company. Pro-tip: Keep a standardized boilerplate for your team in your shared drive for easy access. DMZ’s boilerplate is at the bottom of every announcement and follows the same format.

- DMZ is a world-leading startup incubator based at Toronto Metropolitan University that equips the next generation of tech entrepreneurs with the tools needed to build, launch, and scale highly impactful startups. By providing connections to customers, coaching, capital, and a community, DMZ’s customized approach helps innovators reach the next milestone in their entrepreneurial journey – whatever that might be. Through its award-winning programming, DMZ has helped more than 800 startups raise $2.5 billion in capital and create 5,000+ jobs. Headquartered in Toronto, Canada with globally-accessible programming, DMZ has a widely-recognized international presence with offices in Vietnam, India, and the U.S., and partnerships across North America, Latin America, Africa and Asia.

Conclude with a call to action.

Wrap up your press release with a compelling call to action. Consider its purpose: whether you want readers to explore your website, sign up for a mailing list or connect with your team. Here are a few examples of calls to action from past DMZ press releases.

- For founders looking to level–up their startups, visit dmz.torontomu.ca/our-programs.

- For information about DMZ’s global initiatives, visit dmz.to/global.

- Black-identifying founders looking to jumpstart their business can enroll now at dmz.to/bip-launchpad.

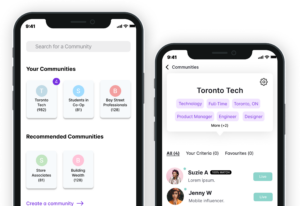

Startup examples.

Let’s bridge theory and practice by looking at tangible DMZ startup examples and how they leveraged press releases.

Announcing a raise:

Announcing an acquisition:

Announcing an award: