How a DMZ startup processed $30 million in rent and helped users earn $1 million in cashback and rewards.

Rent is easily one of the heftiest expenses we all endure. Month after month, an eye-watering sum is removed from our bank accounts.

In the past year, Canada has seen rent jump 10.5% on average, and Canada’s housing affordability crisis has left renters with no choice but to swallow costs.

Canada is becoming a nation of renters, and Co-founder and CEO of DMZ startup Chexy, Liza Akhvledziani, decided to take matters into her own hands by giving Canadians something to show for their largest monthly expense.

“I had been a renter in Canada for way too long and was fed up with landlords asking for cheques and not being able to benefit from paying my largest expense on time every month,” said Liza Akhvledziani Co-Founder and CEO of Chexy. “So I thought, what the hell. If nobody else wants to try this — I will.”

“I had been a renter in Canada for way too long and was fed up with landlords asking for cheques and not being able to benefit from paying my largest expense on time every month,” said Liza Akhvledziani Co-Founder and CEO of Chexy. “So I thought, what the hell. If nobody else wants to try this — I will.”

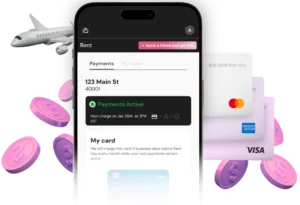

The first tenant-facing payments platform that allows renters to earn rewards and build credit on rent, Chexy has empowered Canadians to no longer look at rent as just another budget line but an opportunity to earn rewards and cashback.

And spoiler alert, people are loving it. In their first year, Chexy processed an outstanding $30 million in rent, and users earned an estimated $1 million in cashback and rewards.

Getting to where they are today hasn’t been a total walk in the park, Akhvledziani explains. “We’ve had our fair share of “oh shit” moments like any startup, but it’s incredible to see the true value we are delivering to our users,” said Akhvledziani.

By empowering renters to pay via credit card, Chexy users can unlock credit card loyalty points, cashback and rewards faster. But don’t just take our word for it; here’s what a few Chexy users had to say.

Chexy user Samir Patel has earned $600 in cashback in just five months by paying rent on the platform.

“Using Chexy has given me the financial freedom to buy extra things or cover my rent partially for a month.”

Since joining Chexy, Brayden Dobson has earned enough points to cover most of his vacations in Mexico, Spain, and Vancouver.

“I am saving 90% off the cost of flights compared to if I paid cash.”

After landing in Canada 5 years ago, Andrew Royal struggled to pay rent via e-transfers due to the maximum daily limits on his account. With Chexy, Andrew doesn’t stress about transfers and is racking up points for an upcoming trip.

“Being able to use my credit card has been a game changer. For the past year, I have been able to make payments on time, every month and get rewards — just for paying my rent.”

Chexy stayed true to its mission: to make rent payments easier and more rewarding for everyone involved. They saw how outdated rent payments were and decided to do something about it.

Looking ahead, Chexy plans to expand its offerings to offer rewards for additional household expenses and, eventually, empower tenants to become homeowners. “Rent is just the beginning; we plan to help users earn rewards on expenses like utilities, tenant insurance and wifi. But, beyond that, another major goal at Chexy is to help our tenants become homeowners with fewer hurdles at a better rate,” said Akhvledziani.

With big plans for the future, Chexy is proving that startups can change the game, one rent check at a time.