Get advice from tech founders who have closed multi-million dollar investment deals for their startups.

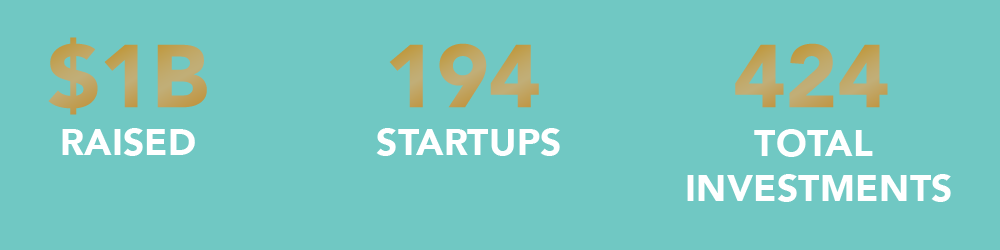

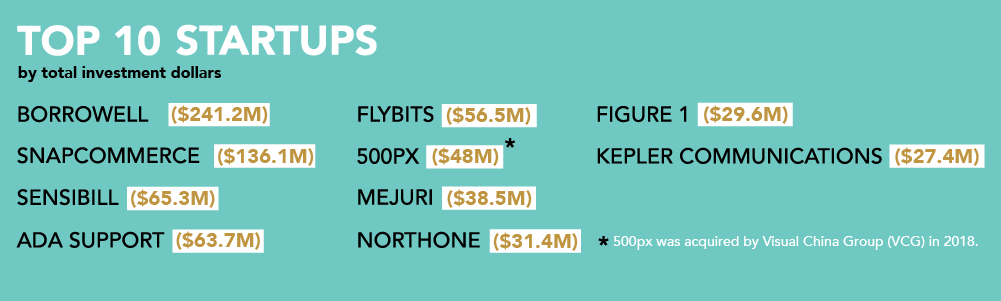

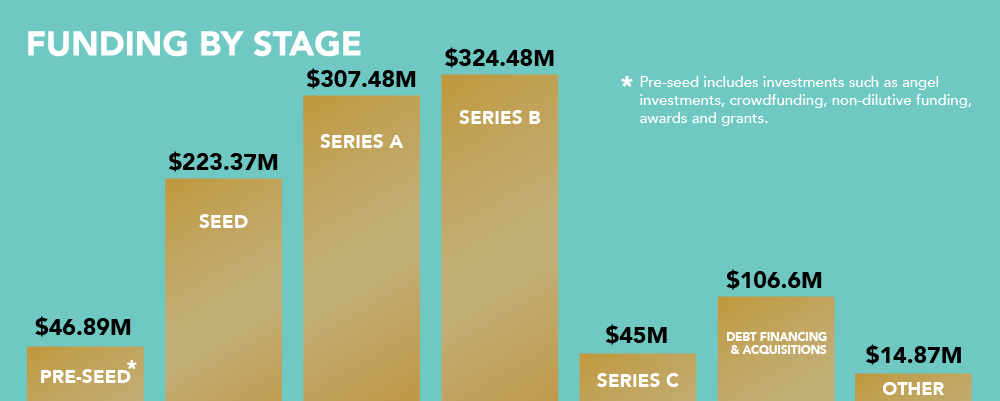

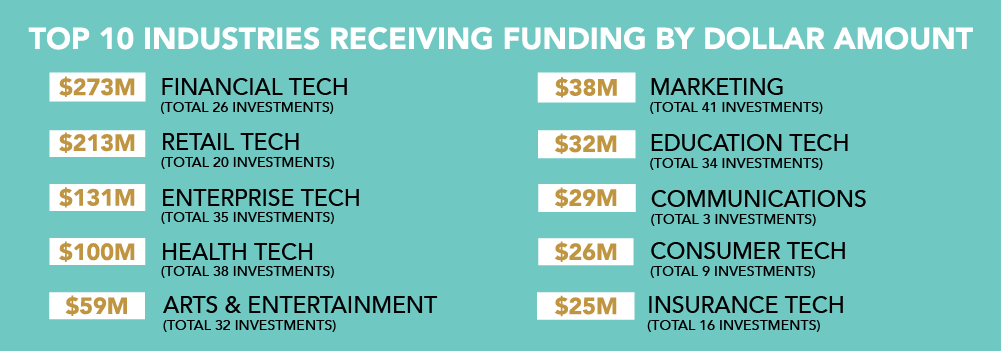

DMZ’s startups and alumni have raised over $1 billion CAD in funding. Curious to learn more about the investment trends, and the startups that helped break $1 billion? Click here.

Let’s face it. If you’re a startup founder, you’ll need to learn how to raise capital at one point or another.

At the DMZ, we appreciate how overwhelming the wild ride of funding a startup can be. Raising capital is, without question, one of the most challenging aspects of growing and scaling a business.

Luckily, many DMZ alumni founders have been successful in attracting investors and securing funding – but, at one time, they were also in your shoes. In light of DMZ startups and alumni breaking $1 billion in funding, we asked founders for their best advice and lessons learned when it comes to startup fundraising.

Here’s what they had to say.

“Create a job description for your ideal lead investor/board member. Evaluate everyone you meet through that lens. Helps flip the power dynamic. Are they the right investor for you?” – Bryan Gold, Co-Founder and CEO, and Adam Rivietz, Co-Founder and CSO, of #paid

What’s new with #paid?

Co-Founders Bryan Gold and Adam Rivetz were recognized as part of Forbes 30 under 30 marketing and advertising list. Read more about their feature here.

“There is plenty of capital out in the market, especially as markets are looking to bounce back from Covid. Founders need to focus on their business and the pain points they are looking to solve first. Get some early adopters and initial traction to prove the product market fit and the capital will follow. Founders often make the mistake of going after capital first to bring the idea to fruition, but with tools and resources these days, getting an MVP out by bootstrapping has become a lot easier.” – Kumar Erramilli, CTO and Co-Founder of ACTO

What’s new with ACTO?

ACTO’s growth was accelerated following an $11.5 million USD funding round last August. Since then, ACTO has made two strategic acquisitions to bolster its mobile learning and patient-facing education capabilities, building on its promise to deliver true omnichannel education for learners within the care industry!

“Many tech founders look to raise capital to fund the development of a product or service, but bootstrapping and getting small loans from friends or family not only serves as a good vetting for your idea, but also can carry you through early development and allow for closing of the first couple of sales. This can go a long way to getting a better evaluation for your capital raise and minimizes costly early dilution.” – Adrian Bulzacki, Founder of ARB Labs

What’s new with ARB Labs?

ARB Labs launched ChipVue, a new optical based bet recognition™ system that provides real-time slot-like analytics for blackjack, baccarat and other carnival style table games. Learn more about ChipVue here.

“Be very mindful of the investors you bring on board and really understand their motivations, expectations and their ability to support and partner with you over the years. Bringing on an investor is analogous to being in a marriage and so focus on building those relationships.” – Nishaant Sanghavi, CEO and Co-Founder of EnergyX

What’s new with EnergyX?

EnergyX was 1 of 6 tech firms in Toronto chosen by the federal government to receive funding to help support their long term growth. EnergyX is receiving $500,000 to expand its customer base and increase automation!

“Don’t build everything in-house! Many tools out there can create the “Wizard of Oz” effect of your product.” – Karen Lau, Co-Founder and CTO, and Michael Van, Co-Founder and CEO, of Furnishr

What’s new with Furnishr?

Furnishr is growing! They are expanding their operations, sales and development teams. For more information on how to apply click here.

“When looking for investors, don’t be afraid to branch outside of Canadian borders.”– Eropa Stein, CEO and Founder of Hyre

What’s new with Hyre?

As a result of the COVID-19 pandemic, Hyre pivoted and now offers an employee scheduling platform for the healthcare industry, in addition to the hospitality and restaurant industry.

“The right fit with your investor is worth waiting for if you can afford it.” – Karim Ali, CEO of Invision AI

What’s new with Invision AI?

Invision AI has joined forces with Thales and Metrolinx to develop advanced autonomous technologies for rail systems with support from the Ontario government through Ontario’s Autonomous Vehicle Innovation Network (AVIN). Plus, they recently announced they have successfully completed high performance portable roadside vehicle occupancy detection field tests with over 97.5% precision!

“Invest time in building your network. Create connections with people in the industry well in advance of needing the funding. When you are ready to start raising money, it will come much easier if you have developed the right connections.” – Erifili Morfidis, Co-Founder and Co-CEO, and Charlotte Gummesson, Co-Founder and Co-CEO, of iRestify

What’s new with iRestify?

With the onset of the global pandemic, iRestify had to make some tough decisions and pivot as most of their clients, which were commercial office tenants, no longer had use for their space. As a result, they shifted their efforts and focused on the multi-residential property management sector. Learn more about their story of determination and growth here.

“Fundraising is 70-80% preparation.” – Casey Binkley, Founder and CEO of Movia

What’s new with Movia?

Movia recently partnered with Corus entertainment to help launch two new tv shows, The Equalizer and Clarice. Movia’s truck advertisements offered the chance to bring the big screen feeling to the ads themselves, along with the ability to reach target audiences. Check out the full case study here.

“Think long and hard about what you want to accomplish with your business, and what’s most important in your life before you raise a dollar.” – Corey Gross, CEO and Founder of Sensibill

What’s new with Sensibill?

Sensibill announced their new Sensibill Platform, which includes two new solutions, Spend Manager and Spend Insights, which aims to give financial institutions deeper data and insights needed to better serve and nurture financially resilient, loyal customers. They were also awarded with FinTech Breakthrough’s personal finance innovation award!

“Having access to required capital is a critically important aspect of growing a new venture. For new tech founders, surround yourself with trusted advisors who can guide you through the process of the structuring for and raising of capital. Having good advisors to be sounding boards for investor materials and your pitch is important. Treat raising capital like sales: create the right messages ahead of time, build a good funnel of prospects, get active and communicate often, don’t be afraid to hear the word no, listen to the feedback, but be selective on what you choose to refine, celebrate your wins and keep going. Treat your investors well as they can be extremely helpful in finding other investors. Most importantly, be yourself and speak confidently about your venture.” – Brian Deck, CEO of Smooth Commerce

What’s new with Smooth Commerce?

Smooth Commerce has launched great brands including Mary Brown’s, Fresh, Denny’s, Chop Steakhouse, Maker Pizza, Pizzeria Libretto and many more. Plus, Invest in Ontario named Smooth Commerce as one of the top 12 fintechs to watch in 2021 as they continue to elevate ordering and delivery and they were listed as one of Canada’s 2021 Best Workplaces™.

“The most important part is having product market fit. Have a product that customers want regardless of how ‘beta’ it is. With that comes growth in your key metrics and makes everything a lot easier!’ – Hussein Fazal, CEO and Co-Founder, and Henry Shi, Co-Founder, of Snapcommerce

What’s new with Super (formerly Snapcommerce)?

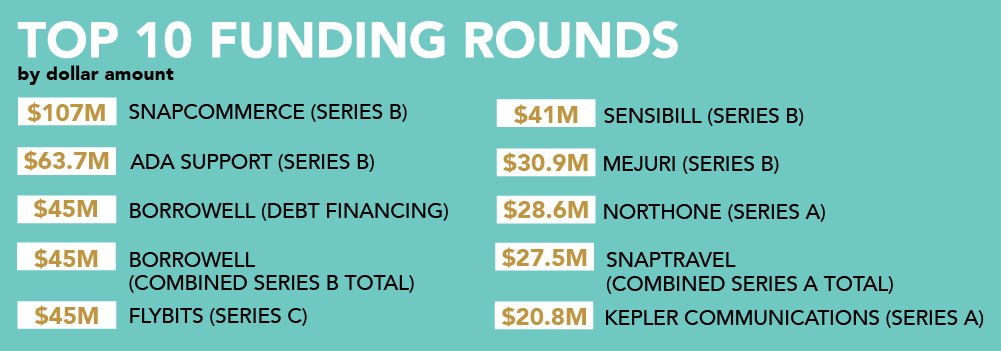

Super (formerly Snapcommerce) recently secured $107 million CAD in growth funding, signalling confidence from investors in the company’s mission to expand beyond the travel industry! With the new round of funding Snapcommerce is looking to expand in different verticals, hoping to transform the way people shop on their phones.

“It’s sales. You’re not raising funds. You’re selling shares. So run it as a sales process with a deadline. If you think you can generate anything close to the same amount of cash by spending that energy and effort on customers you’d be much wiser to sell products for cash than equity.” – Brennan McEachran, CEO and Co-Founder of Soapbox

What’s new with Soapbox?

Soapbox released a new Zapier integration, enabling teams to instantly connect Soapbox with over 2,000 apps to automate their work and become more productive. Users can now unlock powerful integrations like Asana, Trello and Microsoft To Do.

“Take your time to identify VCs with investment portfolios that are aligned with your specific business sector. “ – Laura Bryson, COO and Co-Founder of SWTCH

What’s new with SWTCH?

Earlier this month, the federal government announced a $235,000 investment for SWTCH to install 61 electric vehicle chargers across Ontario and Quebec. By leveraging SWTCH’s solution, the government hopes to encourage the adoption of zero-emission vehicles and provide consumers with more green options to charge and drive their vehicles!

“Raise money only when it’s absolutely necessary. You want to raise money when you feel like you will get favourable terms. To get favourable terms, you need to show traction and that takes time. So instead of coming up with an idea and thinking “I need to raise money”, try to do as much work to prove out the value of that idea (create a non-functional wireframe, get feedback from potential customers, etc).” – Swish Goswami, CEO and Co-Founder of Trufan

What’s new with Trufan?

Trufan announced the completion of its $2.3 million CAD seed round this past March, bringing their total funding to $4.1 million CAD. They plan to launch a consolidated platform later this year that will allow any brand to generate, segment, and activate first party data.

“My advice to founders raising for the first time: spend a few weeks preparing all your materials and test out your messaging on a variety of audiences. Once you go out to raise, run a rigorous process and focus on finding the best partner that will support your vision for your business.” – Monika Jaroszonek, CEO and Co-Founder of Ratio.City

What’s new with Ratio.City?

Ratio.City is hiring! Their team is looking for a Lead Product Designer to help them translate user stories into effective and intuitive interfaces. Learn more about the position and apply here.

“Every founder should find one or more capital partners as a growth partner in all aspects of business and life, because the two are inseparable. An ideal investor will be a good companion when say, a global pandemic hits and supply chains are just as disrupted as childcare plans, or when a parent gets ill just as you land a major customer. Together you’ll make difficult decisions and find new opportunities.” – Manu Kabahizi, CTO and Co-Founder of Ulula

What’s new with Ulula?

Ulula recently was awarded the 2021 #StopSlaveryAward by the Thomson Reuters Foundation for their innovative Kufatilia mobile-based impact monitoring project, that reports mine accidents, theft, corruption, fraud, child labor, environmental issues, and more in the mining sector.

It took 11 years for DMZ startups and alumni to break $1 billion in funding, but with our current momentum, made possible by our dedicated founders, we are confident we will be able to reach the next billion in a fraction of the time.

Looking for even more expert advice on how to raise? Be a part of the next billion. Learn more about DMZ programming here.